Peace of mind for travelers: choosing the right travel insurance

Travel insurance isn’t optional. From medical emergencies and trip cancellations to lost luggage, stolen gear, and remote evacuations, this guide explains what solid travel insurance should cover, why evacuation memberships like Global Rescue matter, and how to avoid costly gaps in your protection before you travel.

Unfortunately, unexpected and unpleasant things can and do happen when traveling, no matter how close to home or short a journey may be. Travel insurance protects you from the often high costs of those little surprises—illness, injury, theft, civil unrest, flight delays, violent weather, etc. This is why so many travel companies often require or strongly suggest that clients purchase travel insurance for their trip. Nevertheless, travel insurance remains an afterthought for far too many travelers. If you travel, especially as a photographer to off-the-beaten-path destinations as I do, travel insurance and evacuation coverage are essential, not optional.

I never travel without knowing my wallet and my health is protected with appropriate travel insurance and emergency evacuation coverage. And neither does my wife, business partner, and travel/photography partner, Therese Iknoian. Of course, deciding on the right level of coverage can feel overwhelming, with websites and AI searches showing results that claim this or that insurance is the best for you. And don’t even get me started on the fine print, which often contains confusing disclaimers and exceptions regarding allowable claims. It’s impossible to adequately explain everything you need to know about buying travel insurance in a single article. Thus, in the following paragraphs, I’ll do my best to point you in the right direction and help clear up some common misconceptions, so your next travel adventure is adequately protected.

What is the best travel insurance for adventurous travelers?

Frankly, there is no way to recommend a single "best" travel insurance provider because individual traveler needs vary, and insurance offerings frequently change. However, the following are travel insurance providers I am familiar with and that consistently meet the needs of adventurous travelers.

World Nomads: known for providing comprehensive coverage for a wide range of adventure activities and gear.

IMG (International Medical Group): provides solid coverage for remote destinations, which is why the IMG Signature Travel Insurance plans are offered as add-on travel insurance plans with a Global Rescue membership (more on Global Rescue later).

AIG Travel Guard: offers plans with high coverage limits for expensive equipment.

Travelex: known for comprehensive coverage and good customer service.

What should be included in a good travel insurance policy?

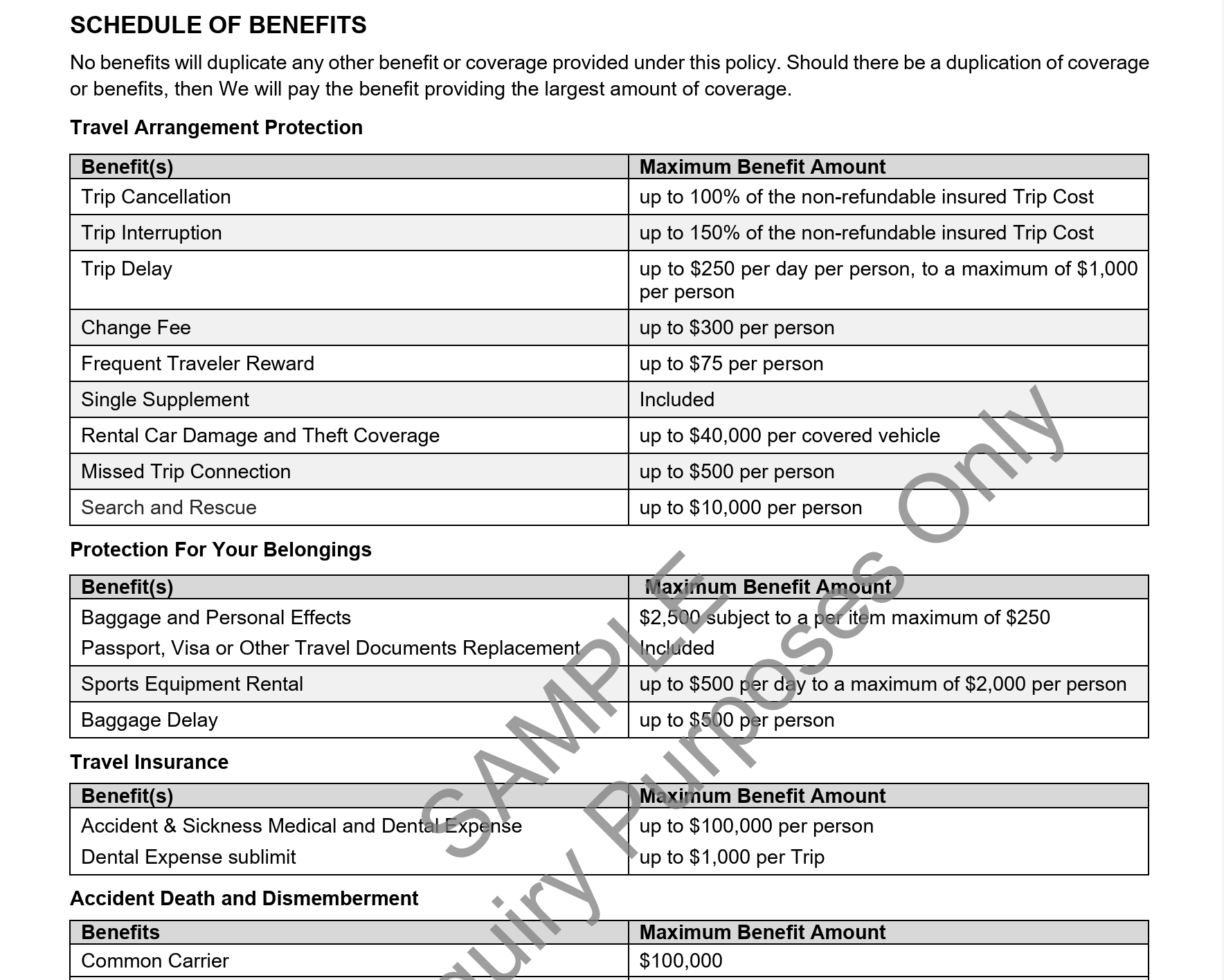

Medical coverage for emergencies is perhaps the most important component of buying travel insurance. But there are really five essential parts to a good travel insurance policy:

1. Emergency medical costs and emergency medical evacuation. If you travel within the U.S., your existing health insurance should cover any illness or injury you sustain. However, international coverage for medical emergencies is often extremely limited. Look for travel insurance that covers doctors’ fees and hospital bills, including dental emergencies, and helps coordinate your care at a medical facility that meets U.S. standards.

2. Trip delay. If a travel delay is due to severe weather, airline maintenance, or civil unrest, then food, lodging, and local transportation are usually covered. Daily limits typically range between $150 and $250 per traveler, and there is usually a total policy payout limit. Save those receipts!

3. Trip cancellation. Look for policies that reimburse you for prepaid airline tickets, hotel rooms, rental cars, tours, cruises, and other nonrefundable expenses if you are unable to travel due to illness or injury, the death of a family member or traveling companion, job loss, military deployment, or jury duty. Trip cancellation coverage should also cover unplanned natural disasters, severe weather, airline strikes, or civil unrest/terrorism events that prevent you from traveling.

4. Trip interruption. If possible, opt for policies that will reimburse nonrefundable expenses if you must cut a trip short due to illness, injury, or a family emergency at home. Some policies will even reimburse the cost of a one-way ticket home.

5. Baggage loss or stolen items. While airlines are required to compensate you for lost luggage, the dollar amounts are pitifully small. Trying to get one airline to assume responsibility when several airlines handled the luggage can be an exercise in futility. Travel insurance offers much higher benefit limits and broader coverage, and it will also provide coverage if your bags and/or contents are lost, damaged, or stolen once you arrive. There are strict limits on what will be reimbursed, so read your policy carefully.

Do I need evacuation coverage in addition to travel insurance?

While many comprehensive travel insurance policies include emergency evacuation coverage, it is often bundled with medical coverage and will not apply if you are injured while engaging in a “prohibited activity,” such as surfing, kayaking, scuba diving, climbing, bicycling, or motorcycling. In addition, coverage limits may be insufficient, and evacuation typically means getting you from one emergency facility or airport to the nearest adequate medical facility, not necessarily the best hospital for you.

Companies such as MedjetAssist and Global Rescue offer stand-alone medical evacuation membership plans. Therese and I wouldn’t consider traveling without purchasing a Global Rescue membership. We rest easy knowing that in the event of a travel emergency requiring field rescue – literally getting us from the point of illness or injury to safety and medical treatment, no matter how remote we are – Global Rescue will protect us. Global Rescue doesn’t care how the injury occurred (meaning no prohibited activities, even mountaineering or skydiving), which is comforting. And the care doesn’t stop with evacuation to an in-country medical facility. If we ever need ongoing hospitalization, we will be transported to our home hospital of choice, which can provide the appropriate level of care. Best of all, unlike travel insurance, there are no claims to file, no deductibles or copays, and no reimbursements to request. Once the membership fee is paid, coverage begins.

Global Rescue also offers security evacuations to members for an additional fee, which could be worth it if you travel to regions where past uprisings have occurred. Even in ordinarily peaceful countries, there is no way to predict whether civil unrest stemming from a government decision might affect our ability to travel safely. Recently, a tour company I know had to cancel a Panama trip before clients arrived because civil unrest made the trip unsafe and impossible to operate. Clients with appropriate travel insurance were reimbursed. However, travel insurance alone would not have helped get clients out of Panama or to safety had any of them already been in the country.

Global Rescue’s membership security upgrade also provides advisory and evacuation services for non-medical emergencies, including government evacuation orders, unexpected natural disasters, civil unrest, and acts of terrorism.

There are times when travel insurance or evacuation coverage won’t help

Even the best travel insurance and evacuation coverage plans have limits, given the many things that can go wrong on a trip. Always read the fine print carefully before making your purchase, and then always follow the guidelines from your travel insurance and evacuation coverage membership to the letter. Claim denials often result from not understanding coverage limitations and claim requirements, or from doing something that is not covered.

Simply put, travel insurance or evacuation coverage membership will not cover you for being an idiot. If you needlessly put yourself in harm’s way, you can be pretty sure the company will reject your claim. There is also no protection for illegal activity or for acting against the advice or instructions of local authorities. Jumping a pedestrian barrier, running across a busy road, and getting hit by a car because you thought you saw a rare bird perched in a tree by the road and had to get its photo? Probably not going to pay your medical bills on that. Missing your flight in Mozambique because you’re in prison after being caught with illegal drugs in your carry-on? Yeah, don’t think travel insurance is going to be much help. Police order an evacuation ahead of a hurricane, but you stay to capture that once-in-a-lifetime selfie and get injured? TikTok, Facebook, and Instagram followers might love you, but travel insurance and even your evacuation membership coverage plan won’t be among your admirers.

Clearing up common misconceptions regarding travel insurance

I contacted travel insurance experts at World Nomads and Global Rescue for guidance on common misconceptions about travel insurance and evacuation coverage:

Lost or forgotten essential prescription medications. Travel insurance covers emergencies beyond a traveler’s control. In many cases, your plan may not cover the loss of your medications. That’s why keeping prescriptions with you, either in your carry-on or securely in a pocket, is essential. Be sure your membership or insurance plan includes a 24-hour service that will help you find a nearby pharmacy (capable of speaking your language) that can refill the prescription.

Travel affected by an earthquake, hurricane, flood, or forest fire. Travel insurance is for the unexpected. You must purchase your plan before an unforeseen event occurs, such as a storm, earthquake, or other natural disaster. For a hurricane, you must purchase your plan before the storm is officially ‘named.’ Always purchase your travel insurance plan immediately after or at the same time you put money down on your trip. If you do this and a natural disaster disrupts or traps you, your plan documents will clearly list the benefits you are eligible for. If you purchase travel insurance after a natural disaster, your trip will not be covered.

Injuries or illness on a trip. If you need medical treatment during a trip, your first call (if physically able) should be to the travel insurance or medical evacuation company’s emergency assistance line. Do not use any travel insurance or membership plan that does not have a 24-hour emergency service. If you need medical treatment, notify the trip guide immediately. They need to know. Also call (or ask your guide or tour organizer to call if you can’t) your travel insurance or evacuation membership emergency assistance line. Although it is rare, I am aware of cases in which a guide, either through lack of experience or for some other unknown reason, did not adequately address a client’s medical needs, resulting in a more serious medical situation. I know that with Global Rescue, the emergency service number provides real-time access to doctors, paramedics, and nurses who can help determine the medical attention you need based on your situation and symptoms.

Another thing to remember is that travel insurance typically does not cover pre-existing conditions (although some plans may offer waivers for an additional fee).

Lost or stolen passports, credit cards, or other documents. Travel insurance coverage may vary by company and policy. Some companies will help you replace these items, while others may exclude them from the policy.

Stolen credit card and personal information. Unfortunately, travel insurance often doesn't cover incidents like this, so taking extra precautions is wise!

Backup guides stepped in when the lead guide falls ill during a dream photography trip. Travel insurance will not cover you for a “loss of enjoyment” during your planned holiday. Travel insurance is designed to protect you against unexpected losses. It’s important to remember that it’s not a guarantee that your trip will go exactly as you envisioned or perhaps hoped.

Insufficient credit card travel insurance coverage. While many credit cards claim to be suitable for travel, few are, and even fewer offer substantial travel insurance benefits. Both the Chase Sapphire Reserve and American Express Platinum (cards both Therese and I rely on when we travel) offer very good travel insurance coverage. Be sure to check each for the exact coverage, as it changes frequently. It is also very important to remember that in most instances, your credit card travel insurance benefits apply only to charges made with your card. This means that if you used your Chase Sapphire to pay for your flights to Kenya for a photography safari but did not use the card to pay for the photo safari, the only expense you can claim should you cancel the trip due to a medical or other emergency will be your flights.

Travel insurance coverage of lost or stolen luggage. I appreciate how it helps with delayed or lost baggage, especially when replacing essential items like toiletries and clothing. I’ve successfully relied on my travel insurance numerous times over the past several years. However, the coverage can feel limited for pricier items, such as jewelry, camera gear, and computers. You won’t be covered if your gear is stolen from a vehicle, even if the car was locked. You also won’t be covered if your luggage is left unattended, which can happen when a hotel stores it in a shared storage room. You’ll also have to prove that the camera equipment is being used personally, not professionally. In addition, travel insurance will not cover you for any rented photography equipment. My advice? Always rely on separate insurance coverage for your photography and computer gear that protects your gear from theft, damage, and more. A Professional Photographer’s Association membership offers excellent coverage for basic photography gear. If you need more than that, I’d recommend looking at photography insurance from Hill & Usher Insurance & Surety, which both Therese and I rely on.

My last bit of advice is to read any policy you purchase carefully to understand its full list of terms, conditions, limitations, and exclusions that may apply to you, and always, always keep receipts. If you still have questions about travel insurance or anything travel-related, I invite you to subscribe to our HI Travel Tales Subscriber Club newsletter.